has capital gains tax increase in 2021

If you sell stocks mutual funds or other capital assets that you held for at least one year any gain from the sale is taxed at either a 0 15 or 20 rate. In 2021 and 2022 the capital gains tax rates are either 0 15 or 20 on most assets held for longer than a year.

Capital Gain Tax Rates By State 2021 2022 Calculate Cap Gains

This is the second time the proposed increase has been.

. Instead of a 20 maximum tax rate long-term gains from the sale of collectibles can be hit with a capital gains tax as high. Implications for business owners. Hundred dollar bills with the words Tax Hikes getty.

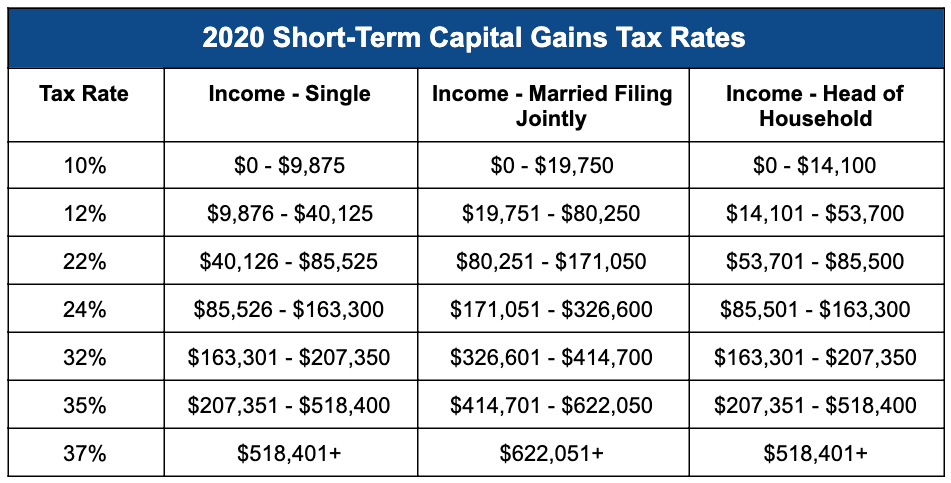

In 2023 the income limits for all tax brackets and all filers will be adjusted for inflation and will be as follows Table 1. The 2021 tax brackets are 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent. Here are 10 things to know.

Filers paid hundreds of billions more in taxes for 2021 and surging capital gains may have been to blame according to an analysis from the Penn Wharton Budget Model. The current 40 estate tax rate applies only to individual estates larger than 1158 million and only to the assets above that amount the threshold is 2316 million for married. 2021 capital gains tax calculator.

2 days agoCapital Gains Tax is charged on gains accrued from the transfer of property buildings land or shares in Kenya. The chart below illustrates how the change in capital gains tax rates affects the sellers net proceeds. Capital Gains Tax Rates 2021 To 2022.

Based on filing status. But the Biden administration has proposed an increase to a top rate of 396 on long-term capital gains and qualified dividends for those with over 1 million in income. This included the increase of GT rates so they were more similar to income tax which was a big problem for anyone looking to sell.

For example if you had 900000 in wages and 200000 in long-term capital gains 100000 of the capital gains would be taxed at the current long-term capital gains tax rate. Tax Changes and Key Amounts for the 2022 Tax Year. Unlike the long-term capital gains tax rate there is no 0 percent.

Many speculate that he will increase the rates of capital gains. Will capital gains tax increase at Budget 2021. In 2021 and 2022 the capital gains tax rate is 0 15 or 20 on most assets held for longer than a year.

2022 capital gains tax rates. The two biggest tax-cutting Conservative Chancellors in British history both increased capital gains tax and for good. Posted on January 7 2021 by Michael Smart.

To address wealth inequality and to improve functioning of our tax. Tax Bulletin 214 July 2021 page 8. Gassman said an increase of the top tax rates.

Those tax rates for long. Corporation reduced net long- term capital. History is a good indicator of the impact of a capital gains increase on.

With average state taxes and a 38 federal surtax. Weve got all the 2021 and 2022 capital gains. The 2021 tax brackets are 10 percent 12 percent 22 percent 24 percent 32 percent 35 percent and 37 percent.

Based on filing status and taxable income long-term capital gains for. The Chancellor will announce the next Budget on 3 March 2021. The 238 rate may go to 434 for some.

Long-term capital gains are taxed at lower rates than ordinary income while short-term capital gains are taxed as ordinary income. There are seven federal income tax rates in 2023. Its time to increase taxes on capital gains.

President Joe Biden proposed a top federal tax rate of 396 on long-term capital gains and qualified dividends. That rate hike amounts to a staggering 82. Relating to the election to increase the percentage of domestic.

Wisconsin 2022 Form 5S Instructions. This may be why the White House is seeking an April 2021 effective date for the retroactive capital gains tax increase as President Biden announced the proposal on April 28.

House Democrats Capital Gains Tax Rates In Each State Tax Foundation

Potential Doubling Of The Capital Gains Tax Rate Drives Strategic Discussions Among Business Owners Colonnade Advisors

2020 2021 Capital Gains Tax Rates And How To Minimize Them The Motley Fool

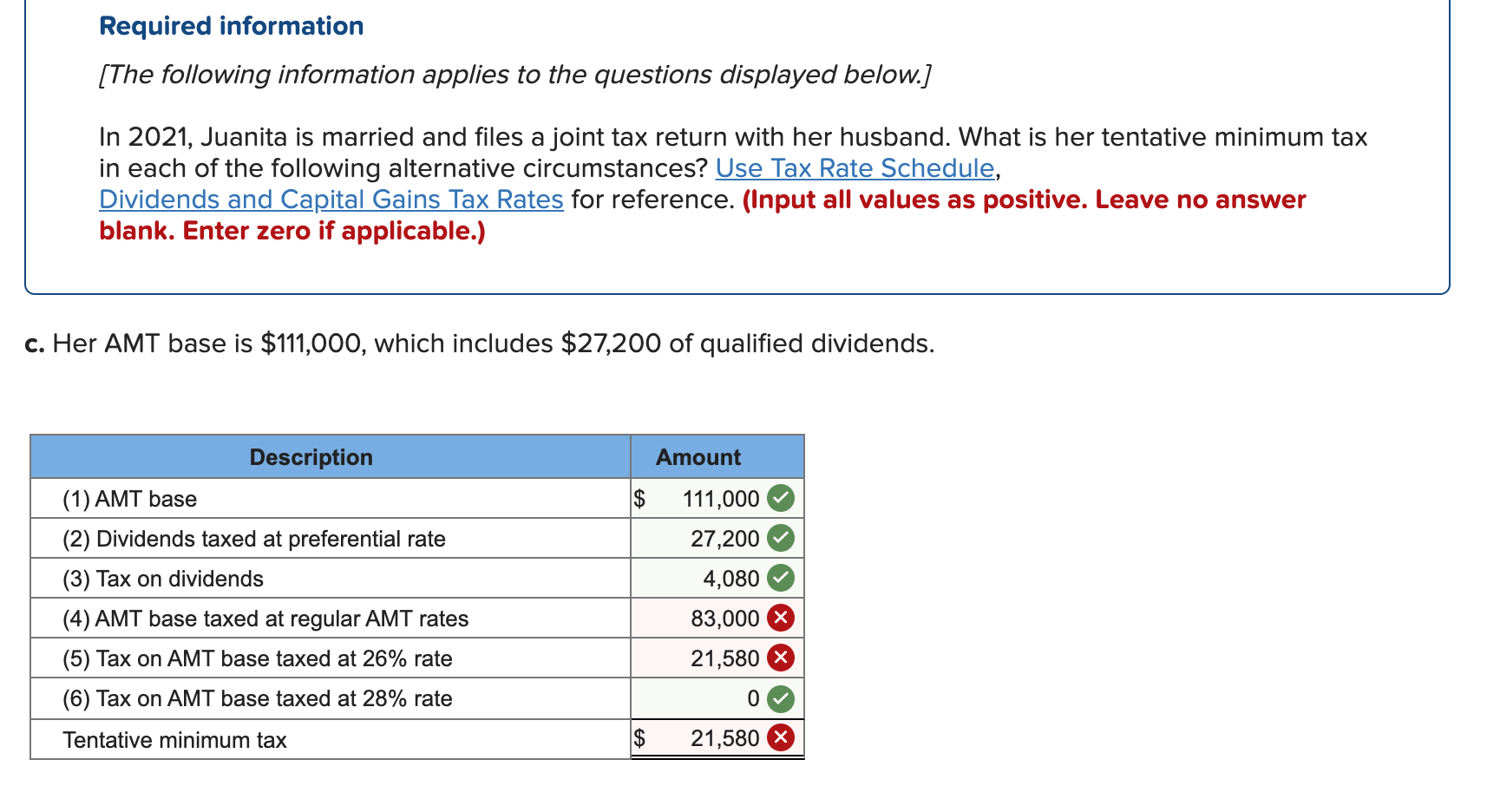

Solved Required Information The Following Information Chegg Com

Preparing For Capital Gains Tax Increases In 2021 Diamond Associates Cpas

How Are Dividends Taxed 2022 Dividend Tax Rates The Motley Fool

Capital Gains Taxes And The Impact On The Sale Of Privately Held Companies

Effects Of Changing Tax Policy On Commercial Real Estate

California State Government Will Lose Big From Capital Gains Tax Increase Econlib

Capital Gains Trade Nears Potential Deadline As Legislation Looms

Capital Gains Are Sensitive To Taxation Jct Report Tax Foundation

The High Burden Of State And Federal Capital Gains Tax Rates Tax Foundation

Income Tax And Capital Gains Rates 2021 03 01 21 Skloff Financial Group

What You Need To Know About Capital Gains Tax

New Capital Gains Tax Increases And Home Sales Osprey Accounting Services

How The Biden Capital Gains Tax Proposal Would Hit The Wealthy

How Biden An Increasing Capital Gains Tax Affects Oz Investing

What Are The Taxes On Cryptocurrency Gains And How Can You Offset These Taxbit

:max_bytes(150000):strip_icc()/what-is-the-capital-gains-tax-fdeabd19e84849e9b12ebdadc1023859.png)