montgomery al sales tax registration

The local tax is due monthly with returns and remittances to be filed on or before the 20th day of the month for the previous months sales. 28 2020 The Alabama Department of Revenue ALDOR is offering taxpayers a quick and easy way to renew sales tax and other licenses which starting.

Sales Tax Alabama Department Of Revenue

Consumer Use Tax Registration.

. Interest For questions or assistance phone 334 625-2036 3. Police Jurisdiction Sales Tax. 10 of tax due.

The current total local sales tax rate in Montgomery AL is 10000. Alabama Department of Revenue. 22-30D-6c One-time registration fee of 5000 for the first year of operation.

Police Jurisdiction Lodging Tax. Montgomery City Sales andor Use Tax. Once you register online it takes 3-5 days to receive an account number.

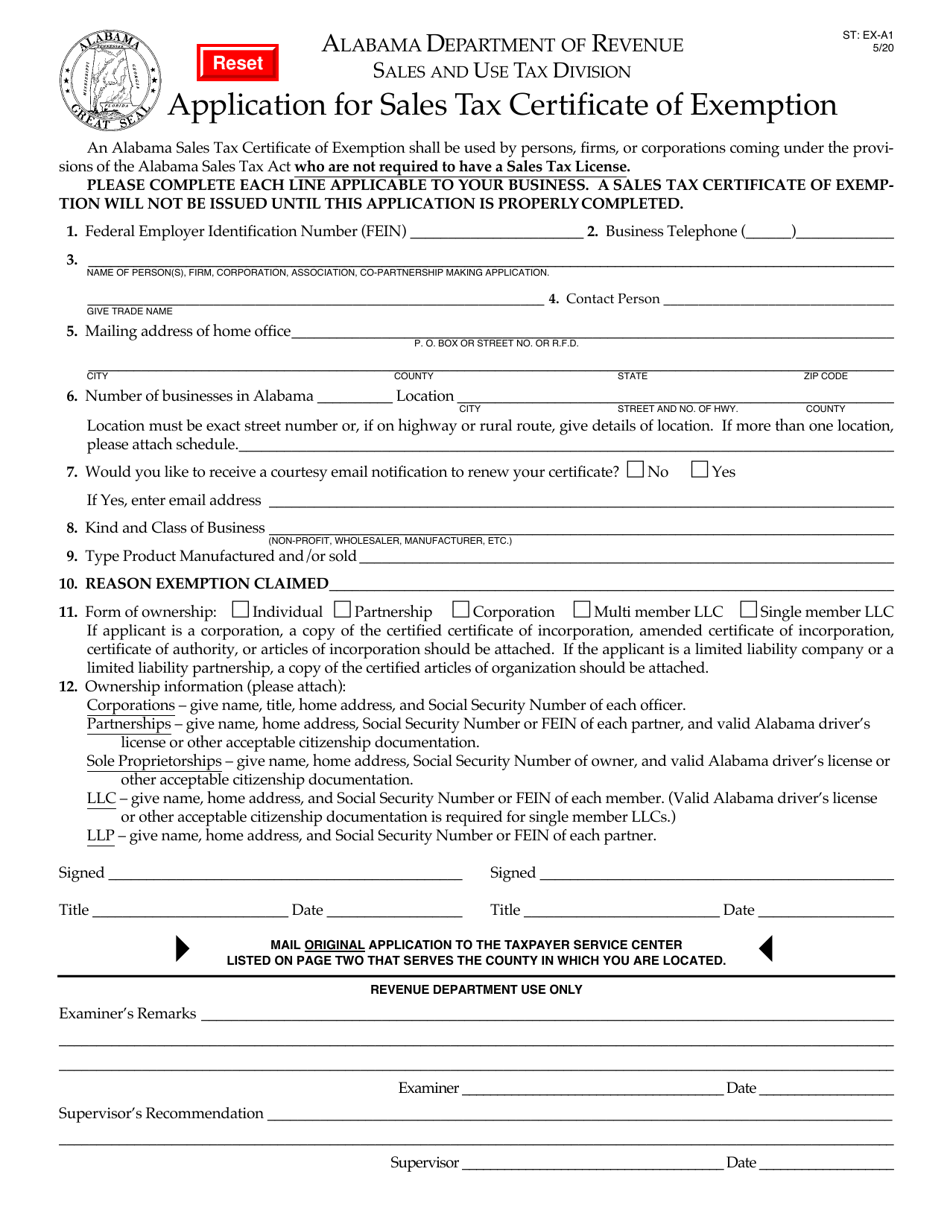

Taxpayer Bill of Rights. Sales Tax Application Form. In addition to the State Sales Tax local sales taxes are also due and these rates vary.

Instructions for Uploading a File. In all likelihood the Application For SalesUse Tax Registration is not the only document you should review as you seek business license compliance in Montgomery AL. Montgomery City Sales andor Use Tax.

City of Montgomery Lodging Tax. Automobile Demonstrator Fee - for automobile. Sales Tax WD Fee.

The minimum combined 2022 sales tax rate for Montgomery Alabama is. Motor FuelGasolineOther Fuel Tax Form. Contractors Gross Receipts Tax.

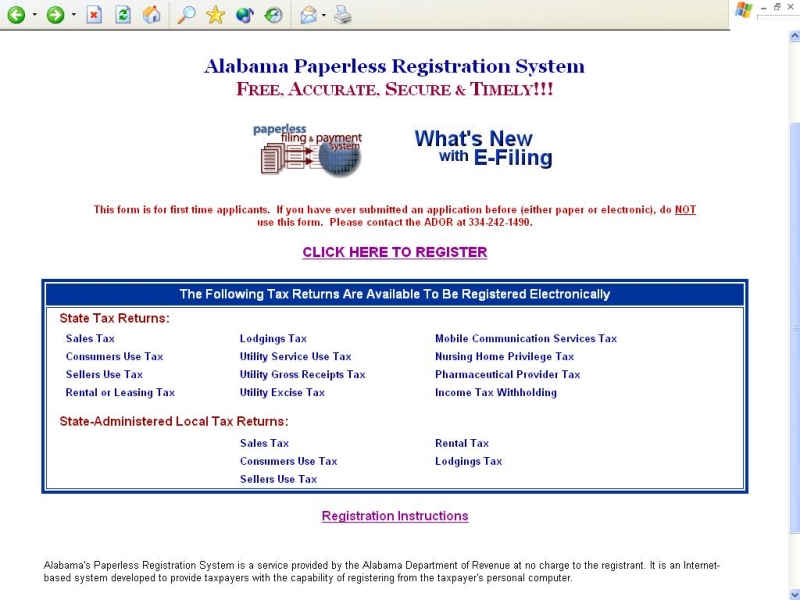

Report an Issue. 10 of tax. Businesses must use My Alabama Taxes MAT to apply online for a tax account number for the following tax types.

However However pursuant to Section 40-23-7. What is the sales tax rate in Montgomery Alabama. In completing the CityCounty Return to filepay Montgomery County you must enter in the Jurisdiction Account Number field of the return.

This is the total of state county and city sales tax rates. Box 1111 Montgomery AL 36101-1111 4. The December 2020 total local sales tax rate was also 10000.

SalesSellers UseConsumers Use Tax Form. Penalty - Late Payment. Interest For questions or assistance phone 334 625-2036 3.

Request BirthDeath Certificates. Box 1111 Montgomery AL 36101-1111 4. City of Montgomery Sales Tax.

For the second year of. Itemized Bill of Sale showing break down of sales tax collected Previous registration information if available Vehicle purchased from a licensed dealer from another state. Sales Use Tax Division.

This form is used to apply for a Sales Tax Permit Use Tax Permit Off-Road Heavy Duty Diesel Powered Equipment Surcharge Telecommunications Infrastructure Fund Assessment. Penalty - Late Payment. Emergency Rental Assistance Montgomery County.

Alabama Sales Tax Guide And Calculator 2022 Taxjar

Alabama Medical Sales Tax Exemption For Implants Agile

How To Get An Alabama Sales Tax License Alabama Sales Tax Handbook

Sales Tax Alabama Department Of Revenue

Form St Ex A1 Download Fillable Pdf Or Fill Online Application For Sales Tax Certificate Of Exemption Alabama Templateroller

Alabama Tax Title Registration Requirements Process Street

How To Register A Business In Alabama Al Dor Sales Tax

How To Register For A Sales Tax Permit In Alabama Taxvalet

Alabama Department Of Revenue Facebook

Alabama Department Of Revenue Facebook

Sales Taxes In The United States Wikipedia

State Sales Tax Exemption Alabamapta

Sales And Use Alabama Department Of Revenue

Newsletter Archives Alabama Arise

Alabama Set Up Your Online Filing Account Taxjar Support

2001 Form Al St Ex A2 Fill Online Printable Fillable Blank Pdffiller

Fillable Online Revenue Alabama Application For Sales And Use Tax Certificate Of Exemption Revenue Alabama Fax Email Print Pdffiller

Montgomery Alabama 1952 Postcard Sidney Lanier High School Ebay